Polish offshore wind farms may have to be assembled in installation ports abroad, because there won’t be one in Gdynia for a long time. But will the port-that-is-to-be fall under Chinese control if NATO fails to prevent it? – asks Wojciech Jakóbik, editor-in-chief at BiznesAlert.pl.

An installation port that wasn’t

Poland wants to have 5.9 GW in offshore wind energy by 2030 with the first farms ready to go in 2025, which is four years from now. The Polish economy would benefit from growing this industry, which needs significant subsidies in the form of a contract for difference as set out in the Offshore Act, provided the level of local content is sufficient. The forecast for this participation ranges from 25 to even 50 percent, but according to Jaroslaw Broda from Orlen’s Baltic Power the latter level will be possible only in the second phase. It’s not a coincidence. According to unofficial information acquired by BiznesAlert.pl, state owned companies wishing to build offshore, i.e. Polska Grupa Energetyczna and PKN Orlen are looking for installation ports outside our country in order to keep up with the implementation of their plans despite the delays. This seems to confirm the grim forecast made by Bartłomiej Sawicki, who wrote that the offshore wind farms would be built „in installments”.

A resolution on the offshore wind installation port in Gdynia has been adopted, but it does have logistical problems that, while possible to overcome, lower the profitability of this endeavor from day one. Meanwhile, the construction of offshore wind farms is less attractive for the port industry than, for example, container transhipment. It is worth adding that the resolution does not include a deadline for constructing the port, which would have to be ready in 2023-24, in order to be able to assemble turbines in 2025. Meanwhile, the trade unions associated with the port of Gdynia claim that so far the spatial development plans for the port didn’t even mention the plan to use the external port to handle wind turbines. Nor has a deadline been set for making available a replacement port in the tender for the use of the internal port, which is already in progress.

For this reason, Orlen can reserve a port in Bornholm with spare capacity from 2024, and PGE will be left with… Mukran known for storing pipes for Nord Stream 2, provided it even has spare capacity. Mariusz Marszałkowski wrote about this port back in May 2021. This would be a symbolic problem for the government, although the port itself would probably provide reliable investment services. The pandemic has limited access to and increased costs of services, which forces stakeholders to make decisions as quickly as possible. This means the managers concerned about the future of offshore need to assume the installation port in Poland won’t be available and act accordingly. The port must be presented at the beginning of 2022 in order for the turbine supplier, i.e. a foreign technological partner, to be able to appraise the port logistics. Without it, Poles will neither have the know-how, nor the turbines.

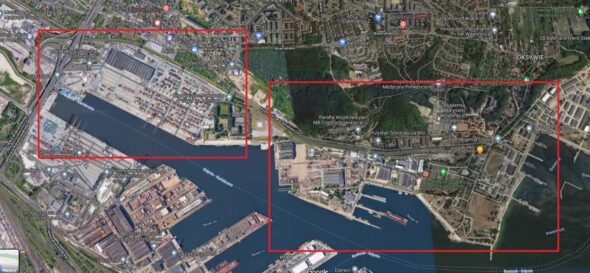

A port with a view on NATO for the Chinese

Meanwhile, the fate of the installation port is being complicated by big politics. BiznesAlert.pl he has already hinted at important reports in other media about the risks for Poland’s foreign policy and NATO security if the Chinese take control over the investment. They are not welcome by the Americans, but also controversial from the point of view of the Polish intelligence agencies. The Gazeta Polska weekly has established that the Chinese have applied for the right to build and lease the future external port in Gdynia, which, among other things, is designated as an installation port for the next thirty years. The problem lies in the fact that the port in Gdynia is located opposite the military area controlled by NATO and the military unit Formoza. There is a risk that if the Chinese take control of the external port, they will be able to penetrate the NATO units for three decades. The Chinese offer is tempting, because it is potentially cheap as the Middle Kingdom subsidizes foreign investments as part of the New Silk Road initiative. However, it is also dangerous from the point of view of NATO, because it could mean that in case of a military conflict Beijing could peek into our window. It is, among other things, through the port of Gdynia that allied aid would arrive in the event of a confrontation in the east. There was a reason why Lithuania prevented the Chinese from taking over the control package at the port in Klaipeda, and leaked to the media that Vilnius was warning its allies about such attempts.

The tender for access to the external port of Gdynia was announced in the controversial formula of public-private partnership, which actually makes it more likely that the Chinese government’s capital will win. In the shadow of the tender for the target installation port, another tender was launched – for the lease of land currently used by the Baltic Container Terminal currently managed by a company from the Philippines, which handles containers at the port in Gdynia. That’s where the temporary installation port would be. Unofficially, there are objections to its format, because it establishes a rent that reduces the attractiveness of the possible port for investors, and also does not guarantee the appropriate carrying capacity, the size of the storage area and other conditions necessary for the construction of offshore wind farms. On November 15, two bids were made – the first by the aforementioned Filipinos from ICTS, the current hosts of the terminal, and the other by the Chinese from Hutchinson, registered in Suzhou.

The problem is that ICTS is the current tenant and can occupy the port until mid-2023, effectively delaying the Chinese takeover. Another risk factor is the reaction of the US and NATO to the possible Chinese monopoly in the port of Gdynia and control of offshore construction and container transhipment, which may end badly for this investment or Poland’s interests. It is hard to imagine that Poland will not follow in the footsteps of Lithuania, which has now inadvertently become an ardent supporter of rapprochement with Taiwan. The installation port has fallen prey to this dispute. New information suggests that if Poland doesn’t build the port on her own and chooses an investor, in 2025 there will either be nothing or a window for the Chinese to spy on NATO.