Polish coal mining has evaded imminent execution in 2027 by the European Union’s methane regulation. The European Parliament has adopted a regulation with amendments beneficial to the Polish mining industry. Methane emission limits for coal mining have been relaxed 10-fold from the baseline document to 5 tonnes of methane emissions per kiloton of coal mined. What do the current regulations look like? How many Polish mines have been saved? Will the country continue to run its power generation on coal? – asks Kacper Jabłoński from the Energy Student Scientific Club at the Warsaw School of Economics.

Mine corridor. Picture by Bogdanka

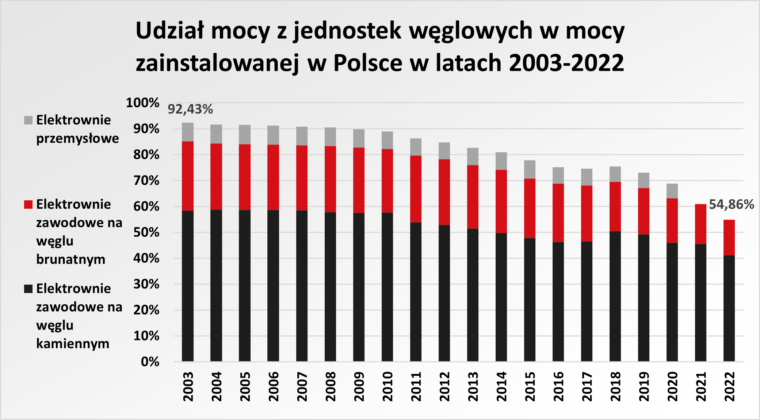

Figure 1. Share of power from coal units in installed capacity in Poland in the years 2003-2022. Author’s own graph based on PSE data from KSE annual reports.

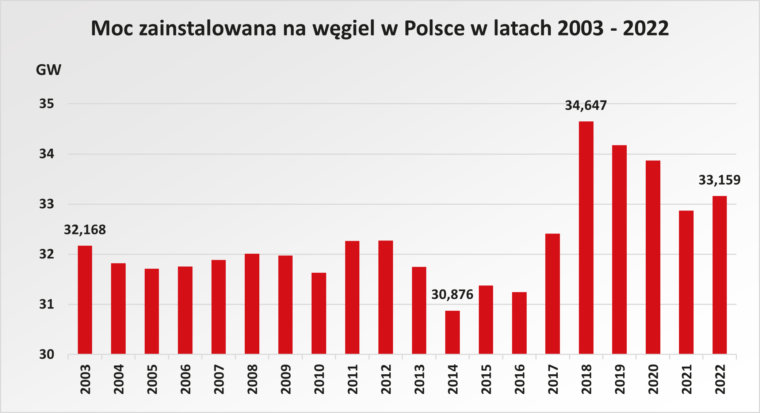

Although the share of installed capacity in coal units in Poland’s energy mix has been declining over the past 20 years, the power generated from coal has increased by almost 1,000 MW during this period. The lowest capacity level in coal units was below 31 GW in 2014 and the highest above 34.5 GW in 2018.

At the same time, the production of Polish hard coal again becomes unprofitable in relation to the prices of raw materials imported from abroad. In 2022, coal imports to Poland amounted to 20.2 million tons, while 44.8 million tons of hard coal were needed to meet the demands of the power generation sector in the same year. This means an increase in the volume of imports by 61.7 percent compared to 2021.

EU regulations were and still are a significant problem for mining, which could lead to the closure of the majority of Polish mines. Poland’s energy generation is based on coal, but what is next?

Figure 2. Installed capacity of coal-fired power plants in Poland in the years 2003 – 2022. Author’s own graph based on PSE data from KSE annual reports.

Methane regulation saved the country’s mining industry

About 80 percent of the bituminous coal mined in Poland comes from methane deposits. Since 2019, the EU has been working on a draft regulation on reducing methane emissions in the energy sector. The project introduces a ban on the release into the atmosphere and combustion of methane during the mine de-methaning process and a restriction on the release of methane from ventilation shafts.

In December 2022, the EU Council adopted methane emission limits for hard coal mining at 0.5 tonnes of methane per kiloton of coal. For a significant majority of Polish bituminous coal mines, this would mean their closure in 2025-2027.

As a result of negotiations conducted by Polish MEPs on April 26, 2023, the methane emission limit was relaxed to the level of 5 tons of methane per kiloton of coal. The new thresholds were introduced through amendments in the European Parliament. The change also includes the way emissions are accounted for, as they will be charged to the operator – the coal company – and not to individual mines.

In addition, penalties for excess emissions have been converted into charges that will go to the budget of the member state and it will be obliged to transfer these funds to the mines for investments in the development of technologies to reduce methane emissions. The project must be approved in the so-called trilogue, also by the Council of the EU and the European Commission.

Poles will probably wait for the other approvals until the completion of work on the RED II directive and the reform of the structure of the EU electricity market, which are priorities of the Swedish EU presidency and the Commission.

The paradox of Achilles and the tortoise

Despite the negotiated concessions, the level of the emission limit is demanding for the Polish mining industry. Currently, according to the author’s calculations based on data from Polish research institutes, Poland emits about 6.5 tons of methane per kiloton of coal mined.

The way to get rid of methane emissions, used by most mines, is to flare the gas, that is, burn it into the form of carbon dioxide. This procedure will be banned in the case of Polish mines in 2031. Meanwhile, methane capture technologies are still expensive and immature, which means that funds for investment in de-methaning could be spent in a more optimal way, e.g. to adapt to the emission-free energy paradigm in line with the European Green Deal.

It is likely that the established limits will only apply for the next few years, so adjusting our mines to the upcoming regulations may turn out to be the „Achilles and tortoise paradox.”

Each time emissions are brought into line with accepted standards, further investment may be required to meet further, more stringent limits.

Can Poland ignore EU regulations?

What if we ignore the rules? In the event of non-compliance with the European Parliament’s regulations, we are likely to experience high financial penalties again in the future.

The conflict with the Czech Republic over the Turów mine showed that the EU has mechanisms that can be used in case of violation or non-compliance with EU law. In this situation, a periodic penalty payment of EUR 500,000 was imposed on Poland per day, which was eventually deducted from the EU funds intended for our country.

Hefty coal charges

The methane regulation (even in its newly negotiated form) should not be seen as a favorable factor for the development of the coal strategy in the Polish energy sector. Although the liberalization of methane emission limits will save some mines from „regulatory death,” they are highly vulnerable to economic disaster.

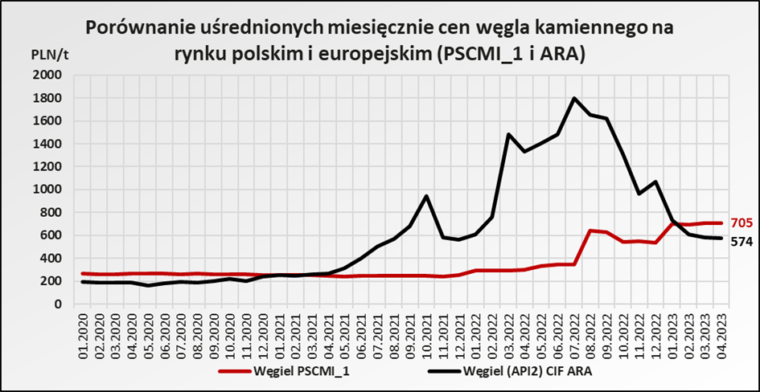

It is not without reason that Poland imports more and more hard coal from distant corners of the world. The competitiveness of low-quality Polish coal decreased with the stabilization of raw material prices on the European market. Comparing indices from the ARA (Amsterdam, Rotterdam, Antwerp) and our domestic markets, it can be noted that Polish coal this year is more (PLN 100 / t) expensive than the raw materials arriving at European ports. For this reason, it is possible to predict further growth and even a record import of hard coal to Poland this year.

After the imposition of sanctions on coal imported from Russia, this raw material is supplied from distant North and South American, Asian, African and even Australian resources. Since we are using cheaper and better quality coal from other countries, it is worth asking whether the efforts to continue local production make sense.

Figure 3. Comparison of monthly average hard coal price indices on the Polish and European markets (PSCMI_1 and ARA-Amsterdam, Rotterdam, Antwerp). Author’s own study based on data from the Polish coal market and Investing.com

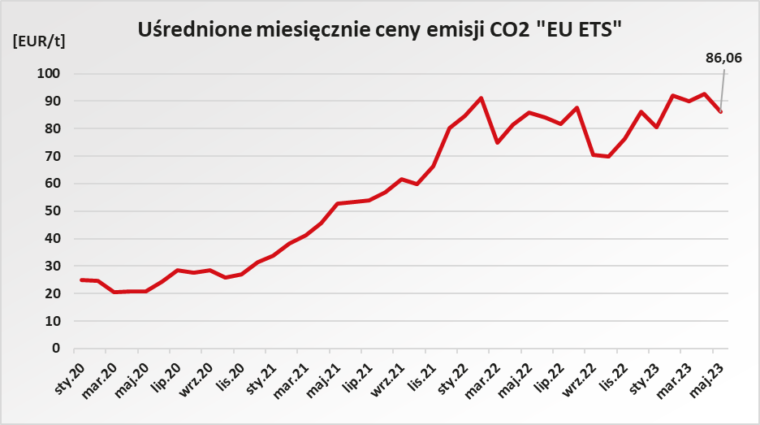

In addition, the price of hard coal for electricity use can be added to the increasingly expensive EU ETS fees resulting from CO2 emissions from the burning of a high-emission fuel such as coal. For these reasons, the continuation of coal mining in Poland becomes extremely unprofitable economically, and changing regulations obliterate its existing, complementary values – political and security-related.

Figure 4. Average monthly CO2 prices of the 'EU ETS’. Author’s own graph based on data from Investing.com

Polish mining brings losses, but it may have a surprise

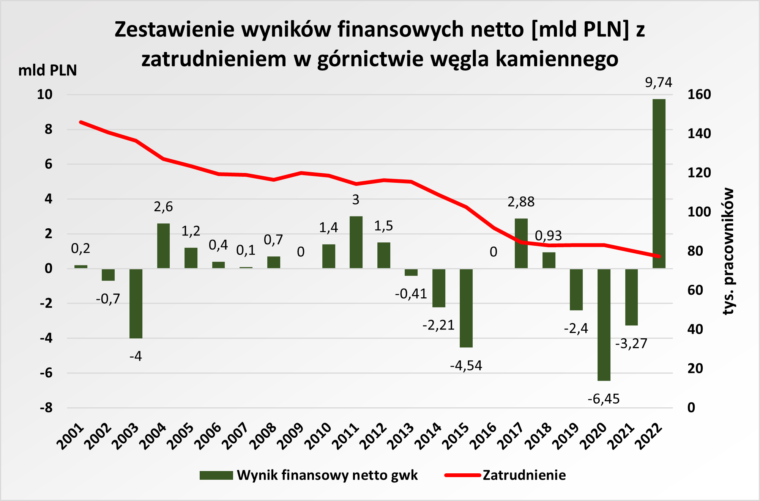

The audit carried out by the Supreme Audit Office was aimed at checking the state of mining and the implementation of the „Programme for the Hard Coal Mining Sector in Poland” in the years 2018-2021. The results of the report from September 2022 stressed that the Polish mining industry is unprofitable and requires regular subsidies from the state treasury.

In 2020, the coal mining sector brought almost PLN 6.5 billion in net losses. The overall assessment highlighted the following: „the programme has been prepared unreliably, without sufficient analysis and, despite the implementation of a significant part of the activities envisaged in it, there is a risk that the profitability of the sector will not be achieved.”

Interestingly, one can see the correlation of the positive financial results of the sector with budget cuts, job cuts or mine closures. These relationships are best illustrated in the year 2004 (closure of 2 mines), the years 2011-2017 (closure of 2 mines). During this period, these mines stood out for some of the better results in recent decades. Productivity in these years increased mainly due to the reduction of inputs, layoffs and closure of unprofitable mines.

The past year has shown that during the unstable geopolitical situation and chaotically fluctuating European commodity market, Polish mining can surprise. It achieved profits of almost PLN 10 billion.

As one can see, the uniqueness of 2022 caused by the Russian invasion of Ukraine can also be manifested by unexpected revenues of the Polish mining sector. However, it is difficult to find positive results for the current year in the forecasts of analysts.

Figure 5. Summary of net financial results [PLN bn] with employment in hard coal mining in the years 2001-2022. Author’s own, based on data from: ARP reports; NIK reports; M. Skibski et al. „Bituminous Coal Mining in Poland” 2020.