Gazprom skillfully uses market tools to play a game, which has a completely non-market character and business and political goals that are aligned with the Kremlin’s agenda – writes Wojciech Jakóbik, editor-in-chief at BiznesAlert.pl.

A new face of the gas crisis

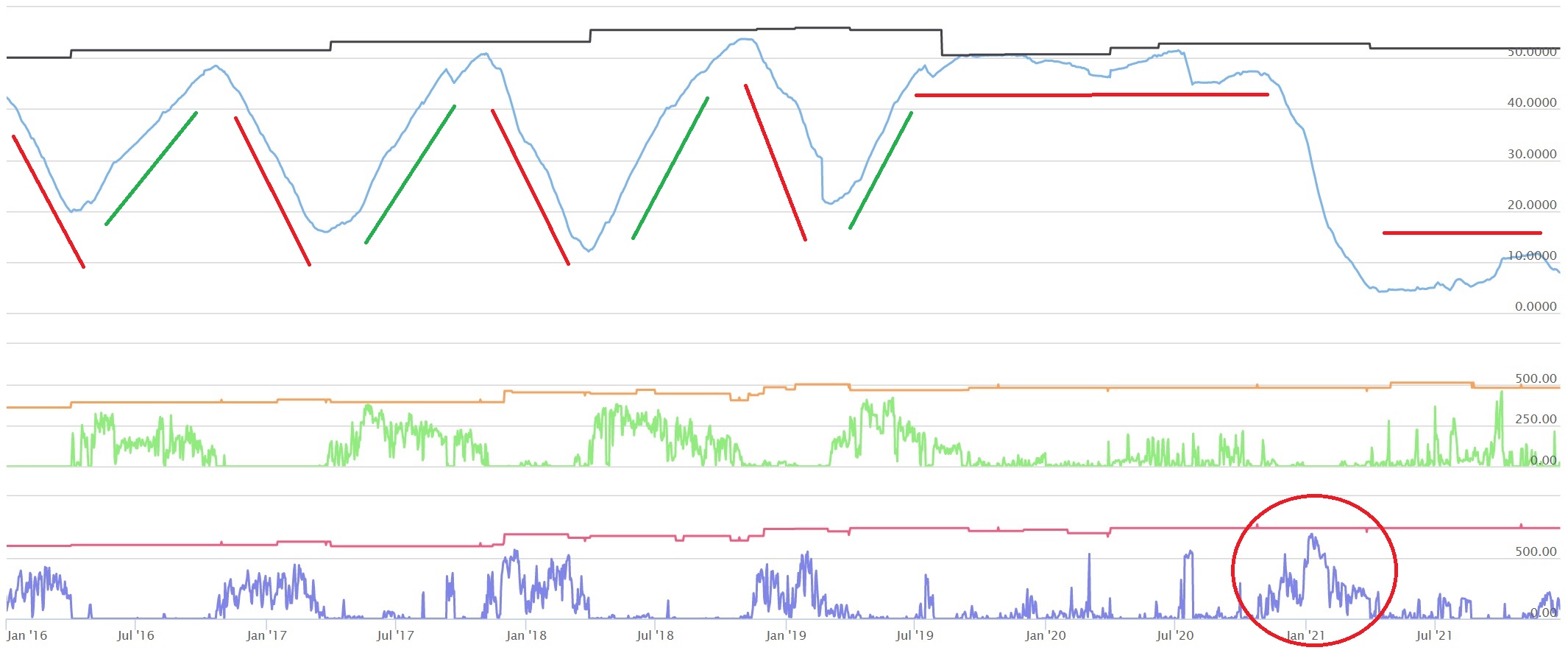

The Russians have not turned off the gas tap, nor have they threatened with a new gas crisis. Hiding behind routine procedures, they are limiting the supply of this fuel to Europe, waiting for the other side to take certain steps. Gas reserves in European storage facilities, co-owned by Gazprom via the Astora company, are at a record low level. Russians did not replenish stocks in the summer of 2021 after they were at a high level after the 2020/21 heating season, when the demand on the market had been record low, due to the pandemic restrictions. Historical data from Astora’s storage facilities in Germany, dating back to January 2016, show a relatively regular process of gas replenishment in the summer, when the fuel is cheap and demand is low, and a draw in the heating season, when it becomes more expensive and demand increases. Because of the pandemic, 2020 was clearly different, as gas consumption during the heating season was at a record low. The graph depicting gas storage levels after a period of regular waves, shows reserves at a high level, which had persisted from the end of 2019 to the autumn of 2021. Contrary to the previous years, the stocks have not been used up, because the restrictions introduced due to the pandemic decreased economic activity, and consequently the demand for gas. Another anomaly was the onset of winter in early 2021, when gas consumption from storage facilities suddenly increased to a record level on the 4th of January 2021.

It is worth recalling that in 2020 Gazprom transmitted to western Europe and Turkey 135.75 billion cubic meters, including 45.84 bcm to Germany, the biggest recipient. At the same time, it sold 39.14 bcm to Central and Eastern Europe, of which 9.67 bcm ended up in Poland. This gives a total of 174.89 bcm in 2020. Gazprom predicts that sales to western Europe, Central and Eastern Europe and Turkey, not counting the countries of the former Soviet Union, will reach 175-183 bcm in 2021. This means that gas export from Russia remains stable, despite record gas prices, which could suggest that the sale should go up as that would be in the economic interest of the company, regardless of the importers’ pleas for more deliveries. Interestingly, this topic appeared on one of Gazprom’s press conferences back in April 2021, and the head of Gazprom Export responsible for sales abroad Elena Mayorova, said that she would plan the export policy depending on the results of the first quarter of this year. The data in question revealed record-low stocks and high draw, as well as record sales to the so-called far abroad (the aforementioned Europe and Turkey without the former Soviet countries). Between January 1 and April 15, 2021 it went up by 28 percent year on year, to 60.5 bcm. After breaking these records, the Russians probably decided to limit sales to Europe.

As early as the summer of 2021, they continued to boast of a record increase in exports, but this record actually occurred only in relation to the record supply declines of 2020 caused by the pandemic restrictions. Gazprom Export reported sales of 115.3 bcm to countries outside the Commonwealth of Independent States in the first half of 2021. This is a year on year increase of 23.2 percent, or 21.7 bcm. However, deliveries in the first half of 2021 were actually lower than in January-June 2018, when there was an actual record of 117.1 bcm. At the same time, Gazprom transmitted 198.97 bcm to the Old Continent in 2019, and in 2020, which was affected by the pandemic, only 174.9 bcm. This means that Gazprom has reduced exports to Europe and Turkey in comparison to the figures from before the pandemic, despite the record prices during the energy crunch, and also expects significantly smaller deliveries in 2021 (the mentioned range of 175-183 bcm) than in the pre-pandemic 2019 (198,97 bcm). This went against the expectations in Europe, which presumed Gazprom would increase the sale and prices would drop. Gazprom acted contrary to market logic. However, the Russians follow their own way of thinking, that is a mix of business and politics.

Market game or political game?

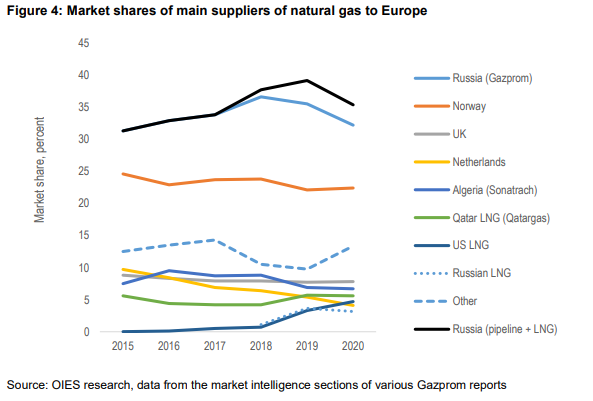

The data from the Oxford Institute for Energy Studies (OIES), a think-tank known for explaining the Russian point of view, show that the oversupply of gas in Europe in 2020 caused a record low price, an increase in LNG sales and a decline in Russia’s market share, as it lost out to competitors. The increase in LNG supply to Europe in the first half of 2020 was combined with a decrease in purchases from Gazprom. LNG supplies from the USA reached 9.3 bcm in the first half of 2020. Gazprom’s customers who signed long-term contracts must adhere to the take-or-pay (TOP), according to which a portion of the contracted gas volume has to be paid for, even if it is not collected. This means they have room to reduce purchases in Russia by the amount not impacted by the TOP clause, depending on whether they have an alternative, such as LNG, which served as a way out more often than not in 2020. Deliveries to Germany fell by 25 percent year on year in the first half of 2020. OIES acknowledges that Germany has optimized its portfolio by increasing LNG purchases and reducing purchases in Russia to the contractual minimum. An example illustrating this trend can be Poland’s PGNiG, whose contract with Gazprom stipulated that the TOP clause applies to 80 percent of the volume. In 2020 PGNiG brought in about 9 bcm of gas from Russia and almost 4 billion cubic meters of LNG. Deliveries of liquefied gas accounted for 25 percent of imports of this company, and those from Russia – a record low level of 60 percent. Imports through the European stock exchanges accounted for the remaining 15 percent. However, the data collected by the OIES show that the increase in demand in 2021 was significant, due to the aforementioned cold spell in January, among other things. LNG was not enough to cover the additional demand, and customers asked Gazprom for more. Data from the first half of 2021 show that PGNiG increased purchases from Russia by 17 percent, to 4.8 bcm, that is by about 700 million cubic meters, keeping the share of this gas supplier in the vicinity of 60 percent. Meanwhile, according to the latest available data, in the third quarter of 2021, gas import to Poland from the east was at 67 percent (a 1 percent decrease year on year), while 24 percent arrived in LNG tankers (increase by 4 percent). Deliveries from European stock exchanges accounted for 9 percent, which is a decrease of 6 percent. PGNiG’s attempts to maximize imports from outside Russia, while limiting purchases on exchanges hit by record prices, are therefore evident. However, there are reasons why the price on the exchanges was so high, and one of those was Russia limiting the supply. Moscow is not starting a price war to fight for clients, it is trying to maximize its market participation and number of long-term contracts. For this reason, Gazprom fulfils only the minimum contractual obligations, and only books the necessary gas transmission capacity. It pays for the transmission of 40 bcm annually via Ukraine under a temporary contract valid until the end of 2024. The remaining gas reaches Europe via Nord Stream 1, the Yamal pipeline and Turkish Stream. Deliveries via Nord Stream 1 and Yamal-Europa are carried out by auction without transmission contracts. Gazprom reserves their capacity in intraday, daily, monthly and quarterly auctions. The company did not book any capacity on the Yamal pipeline as part of a yearly auction. This does not mean it won’t meet its contractual obligations (PGNiG has reported it does meet them), but it may do it in a less predictable manner – through auctions for shorter periods, which will increase market uncertainty fuelled by emotions, and ultimately result in more price increases. According to IHS Markit, Gazprom’s average pipeline deliveries to Europe fell in October 2021, when the new gas year began, to 322 million cubic meters, compared to an average of 393 mcm per day between April and September 2021. Since the summer holidays, the volume has been dropping in comparison to the average from the 2015-2019 period.

Gazprom’s exchange is another tool used by the company to increase the pressure. While it operates in line with the law, the way it is utilized goes against market logic. Gas prices on Gazprom’s Electronic Sales Platform (ESP) broke records already in April 2021. At that time, they averaged at EUR 13,993 per megawatt-hour, compared with the lowest price recorded in August 2020 of EUR 6,744 per megawatt-hour. Thus, the Russians had a market rationale for increasing gas sales to Europe on exchanges via the ESP. However, they did so to an increasingly modest extent. In a record-breaking session at the ESP on April 15, 2021, they sold 1,323,504 MWh, or 124 million cubic meters. Meanwhile, on October 10, during the last session on the ESP in 2021, Gazprom sold 43 800 MWh, or 4 million cubic meters. The Russians sent to the electronic platform only so much gas, despite the record price of EUR 26,702 per megawatt-hour. Originally Gazprom planned four sales sessions, which were included in its e-schedule: in November – 8, 15, 22 and 29, and in December: 6, 13 and 20. The sessions are usually organized on Monday. However, this did not happen despite the record price and Putin’s promise to increase supply to Europe. The official explanation was that the domestic market had to be given the priority on the orders of President Vladimir Putin on the basis of Gazprom’s estimates, which suggest that the demand for gas in the Russian Federation will increase by 7.5 percent, or 18.6 bcm in 2021-25. Those who share Gazprom’s point of view argue that the pandemic caused a decline in gas production in Russia by 6.2 percent year on year, i.e. by 46 billion to 693 billion cubic meters, of which Gazprom reduced its output by 9.3 percent, or 47 billion to 455 bcm. Gazprom then reduced gas supply to storage facilities by 38 percent, i.e. by 20 billion to 33 bcm. The latest excuse made by the company is that it is not flexible, even though it had already planned to increase production in 2021 by 55 bcm to reach 510 bcm. That’s the most in over a decade. It can therefore be assumed that Gazprom has gas, but does not want to sell it other than on the basis of long-term contracts bypassing Ukraine, for example, with the help of Nord Stream 2 with a capacity of just 55 billion cubic meters annually.

The Russians use coercion and persuasion to acquire new long-term contracts, and more often than not threaten with stopping the supply altogether, like in the case of Moldova, which was forced to sign a new contract, as it didn’t have any alternatives. Sometimes they also explain away the reduced deliveries to Europe with fewer orders from clients in France and Germany, an excuse recently used by President Vladimir Putin during his annual end-of-year speech. However, this is only half-true, because some European customers do not really want to enter into new long-term contracts and prefer to buy gas outside Russia, for example, on the exchange, but there is not enough gas on it, because of Gazprom’s deliberate actions resulting from its original market policy. In this way, the Russians gain long-term security of sale and bypass Ukraine, as long as their customers stay with them longer and agree to a certain supply route. An example of Gazprom’s victory is the deal with Hungary’s MOL, which was signed in 2021 for 10 years, and which can be prolonged by another 5 years until September 2036, and include a volume of 4.5 bcm annually and deliveries via the Turkish Stream, bypassing Ukraine. Moldova is another case. It signed a 5-year contract until 2026, and in return agreed to delay reforms that would make energy integration with Europe as part of the Energy Community possible. Gazprom is also in talks with the German VNG to extend the contract and increase the volume of deliveries started in November 2021, during peak price. Thus, the Russians are using the record gas prices to conclude long-term contracts that will cement their position on the market long after the crisis is over. „Long-term contracts offer prices that are three, four and even seven -times lower,” assured Putin when talking about contracts with Russia’s Gazprom which, in his opinion, are cheaper than the offer on the European exchanges. „The European spot market merely reflects the current state of supply and demand, but is not a valuation tool that can offer equilibrium in the long-term,” the head of Gazprom Export Yelena Burmistrov said. „Those who signed long-term contracts with us, are now happy with their prices,” she added. The current energy crisis will eventually end, prices on the exchanges will again be more attractive than the Russian offer, but the agreements with the Russians will remain.

A gas trap

Gazprom’s game in the Old Continent market is not traditionally market-oriented, because this company sees the market differently from its customers in the European Union. The tycoon from St. Petersburg is playing to increase market share, even limiting today’s revenues to earn more in the future from maintaining its position on the European Union market. The Russians are using available market tools. However, it is not certain that they are acting in accordance with the laws of the market, especially with regard to the antitrust law of the European Union. Gazprom is acting like the OPEC oil cartel, which restricts sales to drive up prices in the hope of regaining market shares lost to shale oil competition. Gazprom is doing the same, seeking to push out the growing LNG competition from around the world, albeit increasingly from the US shale gas sector. This behavior may also be partly explained by the fact that Gazprom remains an instrument of the Kremlin’s foreign policy, which uses long-term gas contracts to achieve certain long-term effects in relations with countries dependant on Russian gas, even at the expense of short-term loss of profit. Moldova is the most glaring example of Gazprom seeking to maintain this dependence, but this problem affects all of Europe, which, by abandoning diversification and becoming dependent on gas during the transition period of climate policy, may increase and extend this dependence for decades, including through hydrogen. I call this phenomenon russification of the climate policy, and falling into dependence on gas from Russia on this route – a gas trap. The energy crisis is another opportunity for Gazprom to play a game that is formally based on market rules, but may also hide substantial political risk, which all Europeans should understand. This is an argument for a second anti-trust investigation that the EC should launch. Arguments in this case have been presented by Poland, Ukraine and other critics of Gazprom, and the Commission is looking into them, having already sent a survey to the Russians on this issue, according to information obtained by BiznesAlert.pl. Moscow is also trying to use the current situation in the short term, to force the start of gas supplies through the disputed Nord Stream 2 pipeline, which, however, will launch only after certification in Germany, which is not expected to occur before the second half of 2022. Russian Deputy Prime Minister Alexander Novak admitted in the fall that there were two ways to reducing the record gas prices in Europe. It’s either selling more gas on Gazprom’s platform, or agreeing to start deliveries via Nord Stream 2. It can therefore be concluded that the Russians are deliberately limiting supply, in order to persuade the Europeans to unblock the disputed pipe.

Revenge of Catherine the Great

Gazprom’s scheme is an argument for avoiding new long-term contracts with the Russians, despite the seemingly attractive offer that is tempting more customers. Poland may also face this temptation in 2022, when high gas prices may still be here. Gazprom predicts that the average price of gas in Europe in the fourth quarter of 2021 will be USD 550 per 1000 cubic meters and the same will happen in 2022, mainly due to record low stocks, which – as we have already established – are so low mainly due to Russia’s Gazprom, because the German storage facilities of this company (Etzel, Jemgum and Rehden) are filled at 16 percent, the Austrian Heidach at 39 percent, and the Dutch Bergemeer at 23 percent. At the same time, the European average is 60 percent. IHS Markit predicts that reserves in European storage will reach less than 15 bcm by the end of March. For this reason, it predicts that prices on the TTF stock exchange in the summer of 2022 will be 25 percent higher than the forecast, and will reach EUR 44 per megawatt-hour in the first quarter and EUR 34 per megawatt-hour in the second and third quarters. This is more than the highest price on Gazprom’s electronic platform in 2021. Next year, Russians may have an argument for long-term contracts, whose price may be lower than the record breaking quotes on the exchange.

Pipeline deliveries from Russia. Graphics: IHS Markit.

Some customers might be tempted, like the Hungarians. One can also imagine that Gazprom’s customers will want to become supply agents in Europe. For example, in Poland, the aforementioned VNG from Germany may someday want to sell more gas through the companies already present there – Handen and Gaz Energia, for example, at the Gaz-System/Ontras interconnection point. The operator there is Ontras, which is part of the EnBW group to which VNG belongs. The reverse flow on the Yamal pipeline in Mallnow may be used by VNG or another provider related to Russia. It is operated by GASCADE, which is equally owned by Gazprom Germania and Wintershall DEA. If the energy crisis continues into 2022, when the Yamal PGNiG-Gazprom contract ends, the Russians will be able to use the „market game” described above to tempt Poland to sign a new long-term contract, instead of continuing spot purchases, to which access is already restricted. Poland will be interested in additional gas, because calculations even before the crisis suggest that it may need an additional 2.1-3.8 bcm annually from 2023 onwards. If the Poles agreed, for example, after early parliamentary elections in 2022, resulting in a coalition with the Polish People’s Party and Waldemar Pawlak, known for extending the Yamal contract in 2010, a new long-term agreement could be concluded, limiting the possibility of further diversification of gas supplies to Poland. It would be similar to the one signed by Moldova or Hungary. It’s not difficult to imagine that such a deal could mean gas will flow via NS2 to Germany and then to Poland, bypassing Ukraine, winning another client for Gazprom and making it possible for the Russian giant to defend its market share. All completely in line with the Kremlin’s foreign policy goals. This would be the second Yamal contract, but probably because of the supply route, it would be called a Baltic deal. The Act on reserves limits this risk. This law allowed Poles, contrary to European trends, to replenish gas reserves for this heating season at almost one hundred percent, which means Warsaw’s gas reserves are the highest in Europe. Otherwise, it could turn out that they would have to replenish their stocks in 2022 from the Katharina storage facility in Brandenburg, which is being expanded by VNG with Gazprom’s help, provided it would even have gas.

Interestingly, the Katharina gas storage facility enjoys the highest reserves in Germany with a level exceeding 70 percent throughput and the largest fuel injection, as if waiting for additional orders. Gas delivered via Nord Stream 2 and stored at a facility named to honor Catherine the Great and sold to Poland would be history laughing in our faces and Gazprom’s success, which is just about business only on the surface. For this reason, Poland should continue the course of reducing dependence on gas from Russia, despite the energy crisis and at all costs avoid reverting its gas policy in 2022. A drastic increase in the cost of gas imports forced PGNiG to borrow PLN 2.7 billion. It is worth considering whether to subsidize this company in 2022, so as not to run out of gas or risk a return to dependence on Gazprom in 2023. One of the tools for achieving this goal is the polonisation of the capacity of the Yamal gas pipeline, which can be used for physical imports of gas from the Baltic Pipe and LNG, but also for spot purchases from Germany. The Poles continue the course allowing not to sign any contract with the Russians, and to supplement the supply from LNG and the Baltic Pipe with spot contracts on the German stock exchange. Despite the fact that in the coming months it will be an expensive option, in the long-term it is more competitive than political deals with Gazprom, and once the crisis is over, it will again be cheaper.