Poland has a huge potential to develop its LNG sector and with a favorable economic policy, it can grow into the largest gas importer in Central and Eastern Europe – writes Magdalena Kuffel, contributor to BiznesAlert.pl.

It is apparent that Poland’s geographic location – its long Baltic coastline and location between Scandinavia and the „continent” – benefits the country (which has been used to our advantage when it comes to gas pipelines). However, without sufficient investments in infrastructure and an adequate diplomatic policy, these advantages may prove to be irrelevant.

The LNG Terminal in Świnoujście, operating since 2015, plays a key role in this puzzle. Poland continues investing in the expansion of the terminal, while looking for opportunities to increase LNG imports and develop a local, competitive gas market. However, this is not the only solution that Orlen is thinking about in the long term.

The second piece of the puzzle is the FSRU; which is a vessel that has on board a regasification terminal connected to a gas grid on land. Such a unit is capable of unloading LNG, process storage and regasification of LNG and providing additional services (including balancing). Depending on the assumptions adopted in the service model, including the breakdown of capacity at the Szczeliny terminal where the regasification and other services are provided, the FSRU could be designed to regasify up to 6.1 bcm a year. If the project is approved, the terminal will be moored in 2028.

The regasification capacity development program also includes the expansion of the National Transmission System, which will allow efficient distribution of gas from the Gdańsk region to customers in Poland and beyond. It is necessary to build new transmission pipelines to fully use the capacity of the new terminal. Currently three investment projects are in full swing.

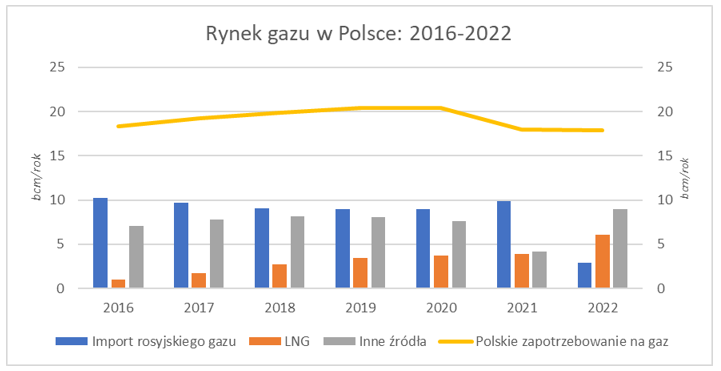

As the chart above chart indicates, the contribution of LNG to Poland’s overall gas mix is gradually growing every year. At the moment, the regasification capacity of the terminal in Świnoujście is 5 bcm, but soon, once the expansion is done, it will go up to 7.5 bcm. Theoretically, Poland will be able to cover its annual demand (approx. 18 bcm per year) with gas from LNG and Norway, thanks to the Baltic Pipe gas pipeline. If we take into consideration the gas that has been imported to Poland from the west (via the connection with Germany), as of 2024 we will have an additional 3.4 bcm of gas ready for export (and an additional 6 bcm once the FSRU is launched).

Graph: Gas market in Poland in 2016-2022. Source: Statista, Eurostat

I believe there is no need to explain how important the ability to import natural gas from countries that are not our neighbors has proven to be since the Russian attack on Ukraine. Since 2022, when Russian gas basically stopped powering our gas pipelines (Russian gas imports fell to 2.9 bcm, compared to 9.9 bcm in 2021), LNG imports by Orlen have increased by more than 50 percent year-on-year, ensuring Poland’s energy security. The main exporter of gas is the United States, which in 2022 sold as much as 3.40 bcm in Poland.

The Orlen Group is clearly satisfied with the cooperation and sees great prospects in the development of the LNG market in Poland. At the beginning of 2023, the company signed a long-term contract with the American company Sempra (based in Texas) for the supply of gas to the terminal in Świnoujście. During the contractual 20 years (counted from the moment of completion of the port), Sempra is to supply Orlen with 1 Mtpa of gas per year. The first deliveries are scheduled for 2027.

However, the United States is not the only supplier of gas to Poland. Since 2016 Grupa Orlen has been importing gas from Qatar (world’s biggest gas producer), Nigeria, Trinidad and Tobago and Egypt.

In the central-eastern region of Europe, Poland is not the only country trying to take advantage of the opportunities offered by LNG. The Baltic states (Lithuania with a terminal in Klaipeda, Estonia and Latvia have expressed great interest in floating terminals that could be docked in their territorial waters) are also investing in structures that will allow them to become independent of Russian gas supplies in the long term. I do not believe that these terminals should be regarded as competition – on the contrary, they may prove to be complementary to the missing Polish regasification capacity, as, for example, was the case with the terminal in Klaipeda. Since 2022, Orlen has received 10 ships, thanks to which LNG after regasification was sent to Poland via the Poland-Lithuania gas pipeline.

In summary, Poland, thanks to its location, can become the largest gas hub in the region of Central and Eastern Europe. It looks like the government is taking appropriate long-term action to seize this opportunity. At the moment it seems that in the coming years we will import much more than the local demand and thus we can have a lot of gas ready for export. Also, it should be remembered that Poland will gradually move away from coal-fired power generation and certainly part of this demand will be covered by natural gas. Nevertheless, I still believe that a large part of the gas could be sent to Germany or Scandinavia, the Czech Republic or Slovakia (and then to the south of Europe), thus allowing international trade.