The energy summit of the European Union and the United States is an occasion to talk about emergency gas supplies in the event of a new war in Ukraine. The gas war waged by Russia in Europe, in which Poland is already a front-line country, should once and for all free the Old Continent of its dependence on resources from the east – writes Wojciech Jakóbik, editor in chief at BiznesAlert.pl.

Is Russia already preparing for new sanctions for the attack on Ukraine?

European Commission President Ursula von der Leyen in a loud interview with Handelsblatt and Les Echos confirmed that Gazprom has reduced the supply of gas to Europe. „(…) we are seeing that last summer and autumn the reserves were not fully replenished as usual, in particular by the Russian energy company Gazprom. While the reserves of all other suppliers are now still at around 44%, the level of Gazprom’s reserves has already fallen to 16%. That speaks for itself,” said von der Leyen. „Gazprom is fulfilling its contracts – that is true – but only at the bottom end of its commitments. Other gas suppliers have increased their supply significantly in response to soaring demand and record prices, but Gazprom has not. The company, which is owned by the Russian State, has thus cast doubt on its own reliability,” she added.

I elaborated on the new game pursued by Gazprom in another article. Probably the company is after new long-term contracts in Europe and a quick launch of the Nord Stream 2 pipeline. In some cases it succeeds in the former, and Hungary is the most visible example, as its latest deal with Gazprom will last until 2036 (!), probably long after the crisis, which for a moment increased the attractiveness of Russian gas, is over. Such contracts more often than not in the end involve significant political costs. Hungary made a concession to Russia as it agreed to receive most of the gas under the additional MVM-Gazprom agreement through Turkish Stream, a gas pipeline bypassing Ukraine from the south. One can imagine that in the future the rest of the gas could reach Hungary via Nord Stream 2 and the hub in Baumgarten, because the receiving point is on the border with Austria, where it is located.

In this context, it is also worth noting Gazprom’s new gas contract with China’s CNPC for the supply of 10 bcm every year for 25 years. The gas is to come from the Far East and increase the volume of supply through the Power of Siberia pipeline, and therefore will not be an alternative supply route to the one from the Yamal peninsula. It will not allow Russia to diversify its outlets. This would require the abandoned project of the Altai gas pipeline or the suspended Power of Siberia 2. This is the same scenario as in May 2014, when, shortly after the illegal annexation of Crimea in March and before the attack on eastern Ukraine in June of that year, the Russians concluded the 'contract of the century’. It was touted as an alternative to the European market, for the same incorrect reasons, namely the use of the deposits in the Far East rather than those exploited for the needs of the European market. I wrote about it elsewhere eight years ago.

One element of the new Sino-Russian agreement that has been highlighted as worrying in the discussions on this issue is the provisions on settlements in euros, which could potentially protect this cooperation from US sanctions. However, currently, the European Commission is also threatening Russia with sanctions that will undermine its hydrocarbon sector. „In this acute crisis, it depends on how Russia behaves. The way Gazprom is doing business is strange. At a time when gas prices are going through the roof and there is huge demand, the company is restricting supply to its customers. Russia is exerting military pressure on Ukraine and using gas supplies as a means of putting pressure on us. That is why it is quite clear that Nord Stream 2 cannot be removed from the table as far as sanctions are concerned,” von der Leyen said in the interview. Perhaps the Russians are already hedging against new Western sanctions, and these would be more likely in the event of a war in Ukraine.

Cold or hot gas war?

From this point of view, a cold gas war in which Gazprom would use the market as leverage and in which, the company’s goal in theory would be to keep its market share, reveals itself as a prelude to a hot war by the Dnieper, which would lead to a paralyzing gas crisis in Europe. The risk of a new Russian attack on Ukraine is so great that the energy summit of the European Union and the United States scheduled for February 7 will be devoted, among other things, to the supply of gas from outside the Russian territory. „I have just set up a strategic energy partnership with US President Joe Biden, focusing in particular on liquefied natural gas (LNG). We are talking to many different suppliers across the world. A lot of countries are very interested in developing good, long-term cooperation with Europe. And Europe wants and offers reliability,” said von der Leyen and mentioned in this context Norway, Qatar, Azerbaijan, Egypt and the USA. She recalled that the US-EU energy summit will be held on February 7 in Washington. She admitted that the idea of building LNG terminals in Germany „makes sense”. It is the supply of liquefied gas alongside the pipelines from Norway that will increase the gas supply to Europe, which may be deprived of supplies from Russia.

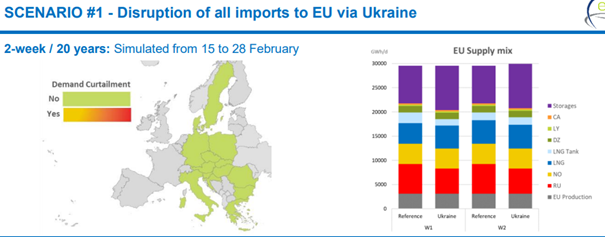

Under the SOS regulation, the European Network of Transmission System Operators for Gas (ENTSOG) is responsible for creating simulations of gas supply crises, the last of which was drafted in November 2021. Interestingly, soon this organization will be headed by a Pole, Piotr Kuś. In the 2021 simulation, ENTSOG did not take into account the onset of winter in early 2021 or Gazprom’s unusual move to limit the supply of gas to Europe since last summer. For example, all ENTSOG scenarios assume a measured replenishment of gas reserves from April to October, while Russian Gazprom did not do so in 2021, leaving reserves in Germany at a record low of less than 20 percent, which have now fallen to almost 10 percent at the Russian company’s facilities in that country. Interestingly, ENTSOG took into account in each scenario the transport of gas via the disputed Nord Stream 2 pipeline, which has not yet occurred, and according to the declaration of the German regulator will not occur before the second half of 2022, which may already be after Russia’s attack on Ukraine. None of the 19 ENTSOG scenarios takes into account a supply disruption affecting more than one gas supply route to Europe or for more than two weeks. In the first scenario, Ukraine stops gas supply via its territory, but does it after the gas storage facilities on the continent are replenished. In this version of events, the use of reserves, the diversion of supplies to the Yamal pipeline, Nord Stream 1, Nord Stream 2 and Turkish Stream, together with Norway and LNG chipping in to cover for the lowered supply from Russia, all make it possible to maintain security of supply without any limitations.

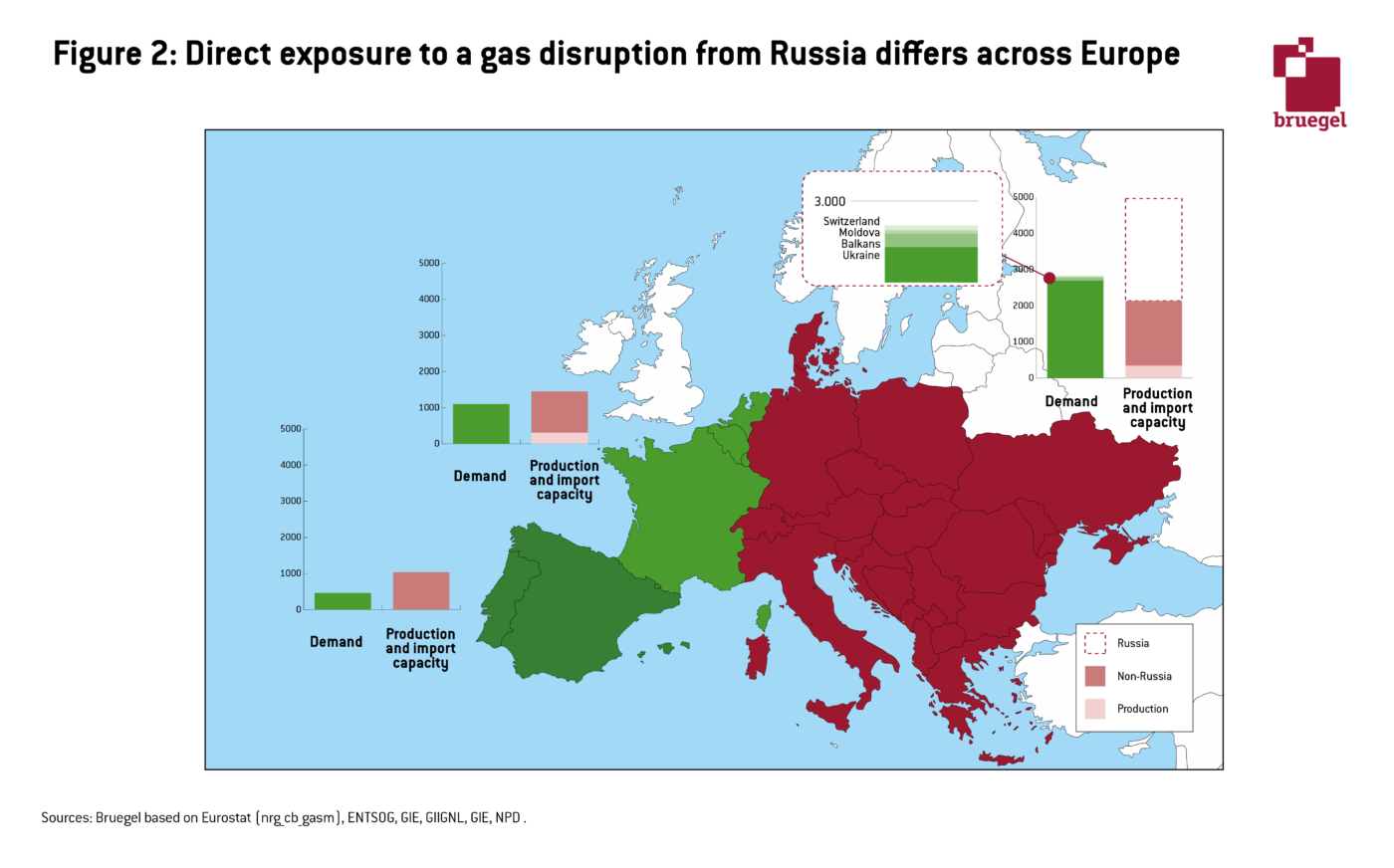

A 2022 analysis by the Bruegel Center shows a dark scenario, which does take into account Gazprom’s uncanny actions. It shows that the attack on Ukraine and the cessation of supplies through its territory will force Europeans to introduce solidarity mechanisms and reduce gas consumption in the industry and households. In this scenario of a gas war in Europe, it will move from the current cold phase to the hot phase, which could include Western sanctions, excluding Russia from the hydrocarbon trade by expelling it from the SWIFT banking system, and thus completely stopping gas supplies to Europe.

What will be the role of Poland on the front lines of the gas war?

Poland has record gas reserves in Europe thanks to the law on strategic reserves of this raw material. According to AGSI + data from the 6th of February 2022, storage facilities in Poland are filled with gas at 62.43 percent. Warehouses in Germany are filled at 35.01 percent, of which those under the control of Gazprom in Jemgum and Rehden are full at 9.38 percent total, of which the latter is almost empty. In the short term, Germany cannot rely on the non-existent LNG terminals mentioned by von der Leyen. So contingency plans for gas supplies to the Old Continent must take into account alternative supply routes that are already in place: in the Benelux countries and in Poland. So far, Germany has been coordinating its gas management policy with Austria, Belgium, France, Luxembourg, the Netherlands and Switzerland in the framework of the so-called Pentalateral Enegy Forum established in 2005. However, the EU regulation on the security of supply (SOS regulation) establishes regional security groups and security corridors that have to draft contingency plans for the crisis currently hanging over Europe. The SOS regulation imposes an obligation to cooperate in the event of gas supply problems, while protecting vulnerable customers, such as schools and hospitals, thanks, among others, to the efforts of Poles led by prof. Jerzy Buzek. Poland and Germany are among two sets of countries exposed to the interruption of gas supplies from the east. For the route through Ukraine, these are: Bulgaria (28.15 percent of storage facilities), Czech Republic (36.59), Germany, Greece (no data), Croatia (30.92), Italy (47.08), Luxembourg (no data), Hungary (31.70), Austria (21.31 – also with Gazprom shares), Poland, Romania (35.88), Slovenia (no data), Slovakia (30.39). For deliveries via Belarus: Belgium (32.56), Czech Republic, Germany, Estonia, Latvia (31.93-for all Baltic countries), Lithuania, Luxembourg, Netherlands (25.73-also with Gazprom shares), Poland, Slovakia. Europeans did not foresee that the Russians would not replenish stocks before the winter in facilities where they own shares. So dependence on Russia in the gas sector took revenge once again, this time through the shareholding of strategic infrastructure, though some warned against precisely this kind of strorage scenario.

The unusual gas storage levels, unforeseen in the ENTSOG simulation, may lead to a hypothetical situation in which emergency gas supplies will this time go from Poland to Germany. According to the SOS regulation, this would be necessary only if all other possibilities were exhausted and the deficit of gas supply to protected customers nevertheless remained. In that case, Germany would have to pay for the intervention supplies with „fair compensation” provided that they did not endanger vulnerable Polish customers. Of course, gas stocks should be looked at not only from the point of view of the percentage of filling of warehouses, but also the actual volumes. Those in the above-mentioned groups of countries are the largest in Italy (93.09 TWh), which is almost five times more than in Poland (22.34 TWh). Paradoxically, the stoppage of gas supplies from Russia to Germany through the Polish section of the Yamal gas pipeline, which has been ongoing since the end of last year, means that the capacity of this pipe could be used for deliveries to Germany.

However, supplies are flowing east through the Yamal. Unofficially, there are two interpretations. According to the first one, the price of gas from the German exchange is still attractive in comparison to the cost of gas as part of the Yamal contract, which is incorrectly presented as being completely dependent on oil prices. It is also to some extent dependent on the exchange thanks to the renegotiation of the contract by the Poles and the intervention of the European Commission in the course of the antitrust investigation. In the current conditions, it may turn out that it is still profitable for the Poles to import gas from the German exchange, because even in the face of the energy crisis, supplies from Russia are not unbeatable. This would suggest PGNiG’s answer to a question posed by BiznesAlert.pl. „PGNiG does not provide information or comment on the details of its gas acquisition strategy. The company benefits from opportunities to obtain natural gas from abroad, which are provided by the LNG terminal in Świnoujście and interconnectors on the borders with Germany, the Czech Republic, Belarus and Ukraine,” the company admits. „Through diversified sources and supply routes, PGNiG actively manages the flow of natural gas, which can lead to periodically significant reductions in the flow of gas at a given point of supply and an increase in the use of other opportunities. Gas supplies from the east are carried out in accordance with the demand reported by PGNiG,” the company ensures. Gazprom is implementing the Yamal contract, but does not transmit more gas despite record demand in Europe.

The second interpretation is more attractive from the point of view of this analysis. Poland as a front-line country of the cold gas war in Europe has already ensured emergency supplies to Moldova, where this war became hot after the introduction of a state of emergency by the city of Chişinău due to a shortage of gas. PGNiG took part in the tender for deliveries of this type announced by Moldovagaz and won. This precedent was followed by a contract for the physical delivery of dedicated LNG cargo from the USA to Ukraine under the PGNiG-ERU agreement. Prime Minister Mateusz Morawiecki declared during his visit to Kiev on February 1, the day of the announcement of this LNG agreement, that Poland will take all measures to secure a new gas connection with Ukraine, which probably entails the Poland-Ukraine gas pipeline put on hold due to the lack of will to cooperate on both sides of the border in the days preceding the current crisis. It is worth recalling that in August 2019 the governments of Poland, Ukraine and the United States signed an agreement on cooperation to strengthen the gas security of the region. „The parties will seek to strengthen the gas interconnection between the Republic of Poland and Ukraine through investments aimed at increasing the capacity of existing or new interconnections and improving cross-border trade, including through reverse transmission capacity,” the document says.

Therefore, it looks like Poland will play a leading role in the gas war in Europe and will be jointly responsible for the transfer of emergency supplies to Ukraine due to the fact that it has an LNG terminal, and by the end of 2022 it will have the Baltic pipeline from Norway, provided, of course, that there are sufficient reserves and the safety of vulnerable customers in our country is ensured. It is worth recalling that the SOS regulation mentions voluntary cooperation with the countries of the energy community, to which Ukraine belongs. However, from this point of view, it is crucial to maintain the reverse of the Yamal pipeline, which gives Poland access to the European gas exchange in addition to connections with the Czech Republic and Slovakia. Nevertheless, it should be noted that Poland will not be the main route of gas supply diversification to the Dnieper, because the main route of gas supply from Ukraine to the European Union runs through Slovakia and it will be the same in the opposite direction. The Ukrainian OGTSUA has reserved the physical, uninterrupted system connection capacity in Budince from the Slovak EUSTREAM for 42 million cubic meters per day, which is 15 billion bcm annually, if necessary. The Polish route has yet to be developed and it is unfortunate that this has not happened yet, mainly for market reasons.

Will the crisis make it possible to deal with the history of dependence on Russia once and for all?

Meanwhile, a new PGNiG-Gazprom dispute over the Yamal contract and the Yamal-Europe pipeline itself is beginning. The Russians responded to PGNiG’s 2020 request to reduce gas prices with a counteroffensive and a request for an increase in October 2021. The Russians also reacted to the act amending the energy law to transfer the right to set tariffs on the Yamal gas pipeline to the hands of the operator – Gaz-System, which is in accordance with European regulations. Gazprom took PGNiG to an arbitration court over its rights to dividends and its rights stemming from the supervision over the Polish section of the Yamal. The Russians are using counter-proportional strikes, but the umbrella of the EU law will theoretically settle the dispute in favor of the Poles, as in the case of the last price arbitration won by them in March 2020. However, it is necessary to reckon with the possibility that litigation will become a pretext for unforeseen actions that affect the security of gas supplies to and through Poland, especially in the face of the risk of a war in Ukraine. The current energy crisis, especially its gas aspect, is an argument for the final abandonment of Europe’s dependence on Russian gas, just as the 20th century oil crisis was an argument for the abandonment of Middle Eastern oil. Just the sole risk that Gazprom’s biggest clients on the continent may be deprived of gas, because of the company reducing its supply, which can only be explained by political ends, should be enough of an argument to make gas diversification policy in Europe happen. This can be achieved through various solutions: the introduction of EU gas reserves, the reduction of gas imports from Russia, the reduction of gas demand in Europe with the help of a duet of renewable energy sources and nuclear energy. The first solution to achieve this goal is to refrain from new long-term contracts with the Russians. President Ursula von der Leyen criticized the dependence on contracts like the Yamal agreement in Poland. „(…) there have been times when short-term supplies have been very useful. There have even been some cases of negative energy prices – that should not be forgotten. The bottom line is that liberalization has proved to be a success. And the current situation, after all, demonstrates the risks involved in long-term dependence on Russian gas,” she said. The current crisis also shows that Europe can emerge victorious and less dependent on Russian gas, and the Kremlin’s aggressive policy will then take revenge on itself, as has happened many times in history.