Poland in talks with neighbors on the FSRU

„Our talks with Czechia and Slovakia are advanced. Recently you and I talked about preliminary consultations with Hungary. Now they’re talking to us about specific capacity,” the Minister of Climate and Environment Anna Moskwa told BiznesAlert.pl. „We are in general talks with Ukraine, which may take until the end of the war. We are aware the current situation makes it difficult for Ukrainians to make any plans. We give them more and more details, expecting that in the future they will be able to make a declaration,” she said.

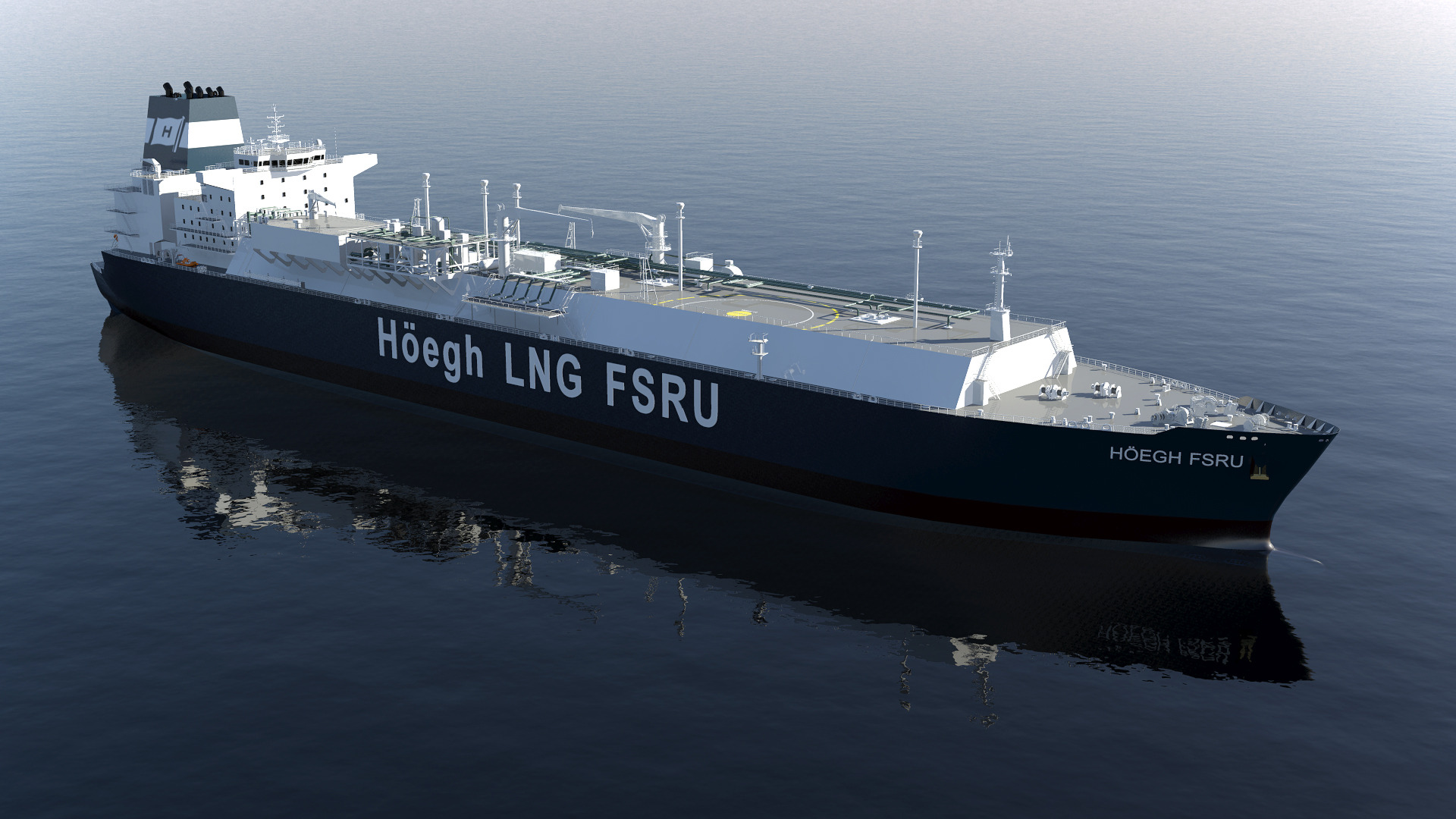

Poland plans to bring a floating storage regasification unit (FSRU) to the Bay of Gdańsk around 2026. The market interest survey showed a demand for 6.1 billion cubic meters annually for the first unit, mainly from PGNiG, which booked access. The talks with the neighbors concern the possibility of acquiring a second unit with a capacity of up to 4.1 billion cubic meters annually, for which the open season procedure to collect binding offers will be held, as reported first by BiznesAlert.pl. The market has expressed a non-binding interest in the capacity.

Wojciech Jakóbik

Poland and the Baltic states want to hit Gazprom’sm cashier

The EU Observer has obtained a letter where Poland and the Baltic States detail their propositions for sanctions against Russia as part of the EU’s 11th sanctions package. Among other things, they want to hit the cashier of Gazprom by excluding Gazprombank from the SWIFT banking system.

The list of Polish proposals has already emerged in the media and BiznesAlert.pl has reported on it. However, the EU Observer has obtained the content of a letter sent by Poland, Lithuania, Latvia and Estonia, in which they describe their proposals in detail.

Those include the exclusion of Gazprombank from the SWIFT system. This institution handles the last gas contracts remaining in Europe after Russia lost this market in result of the energy crisis fanned by Gazprom. The Kommersant daily has calculated that in 2022 Gazprombank handled gas contracts for 61 bcm of grid gas and 22 bcm of LNG. The authors of the letter also demand an embargo on the supply of liquefied gas from Russia. Gazprom’s share in the European market fell to a few percent in 2023, among other things, because Gazprombank demanded payments in rubles not provided for in contracts, like the Polish gas agreement terminated by the Russians in March 2022.

The European Union is to adopt the 11th package of sanctions against Russia for its invasion of Ukraine by the end of April 2023.

EU Observer/Kommersant/Wojciech Jakóbik

Bundestag’s green light. Will Germany sell the Schwedt refinery to the Poles?

The Bundestag approved a change in Germany’s energy law allowing the sale of Rosneft’s assets, including the majority stake in the Schwedt refinery, which the Poles are interested in.

382 MPs voted in favour and 272 against legislation to nationalise Rosneft’s assets to ensure energy security after Russia invaded Ukraine. Interestingly, the CDU/CSU opposition criticized the bill as vague. The Malmendier Legal law office, representing Rosneft, said it would check the compliance of these regulations with the EU.

Rosneft’s assets, including shares in the Schwedt refinery (54 percent), have been under the management of Bundesnetzagentur, the German energy agency since September 2022. The trusteeship was renewed in March 2023 for the first time for six months. Rosneft manages 12 percent of Germany’s refining capacity, as it also has minority shares in two other facilities as well.

There is concern that the Russians could use this influence to the detriment of Germany’s and the region’s energy security. It is worth noting that the Schwedt refinery supplies, among other places, western Poland. Germany abandoned supplies from Russia, and the Poles did not allow Rosneft Deutschland to receive oil via the Naftoport in Gdańsk.

The media are speculating about the possibility of replacing Rosneft with Poland’s PKN Orlen. According to information obtained by BiznesAlert.pl, the regional government and businesses are not interested in such an option. There are other companies on the table, for instance Germany’s Hoyer. Some German politicians suggest that a company from Kazakhstan should be allowed in, which offers Germany oil supplies through the Friendship pipeline stretching through Russia.

Deutsche Welle/Wiedomosti/Wojciech Jakóbik