Gazprom intends to throw Europe off its path to becoming independent from Russian gas. The West must defend itself. Gazprom’s lawsuit against PGNiG is just a foretaste of the gas crisis that could trigger a new war in Ukraine, and impose Russian supply terms on Europe, writes Wojciech Jakobik, editor-in-chief at BiznesAlert.pl.

Gazprom’s new game and privatization of gas policy in Poland

The crisis exacerbated by Russia’s Gazprom has led some to suggest that it is worth stepping down from the path that the European Union, and Poland, are following, and instead sign a new contract with Russia’s Gazprom indexed to oil, as it would lower gas prices. Such a contract would be binding for several years, i.e. long after the end of the energy crisis, and would cement the gas supply terms and conditions, which were questioned by the European Commission in the pre-crisis era as unfavourable to customers. Gazprom is pushing for Nord Stream 2 and establishing a foothold in Central and Eastern Europe through long-term contracts, that I wrote about in another article. The energy crisis will encourage some to abandon liberalization, including Poland, which is approaching a deadline to free gas prices for households, set out in the Polish Energy Policy until 2040. The gas for a second Yamal contract, which I call a Baltic one, would come from Nord Stream 2, which would shape the market in line with Gazprom’s desire, while its intermediaries could privatize Poland’s gas policy as they wish.

A quarter of a century of liberalisation versus three months of an energy crisis

The history of gas market liberalisation in the European Union began in 1998, 24 years ago, when the European Commission and the European Parliament adopted the directive on common rules for the internal gas market. The basic premise of the new legislation is freedom of choice, allowing households and businesses to change a supplier depending on the offer, just like in case of cell phone service providers. If someone doesn’t like the subscription, they move the number to another network. The terms for terminating the contract are specified, and so are service packages and discounts. All this is possible thanks to the development of the telecommunications market, among other things, and to the development of infrastructure that increases the availability of services (network capacity). The liberalisation of the gas market, also possible through the development of transmission infrastructure (supply capacity), is expected to have a similar effect.

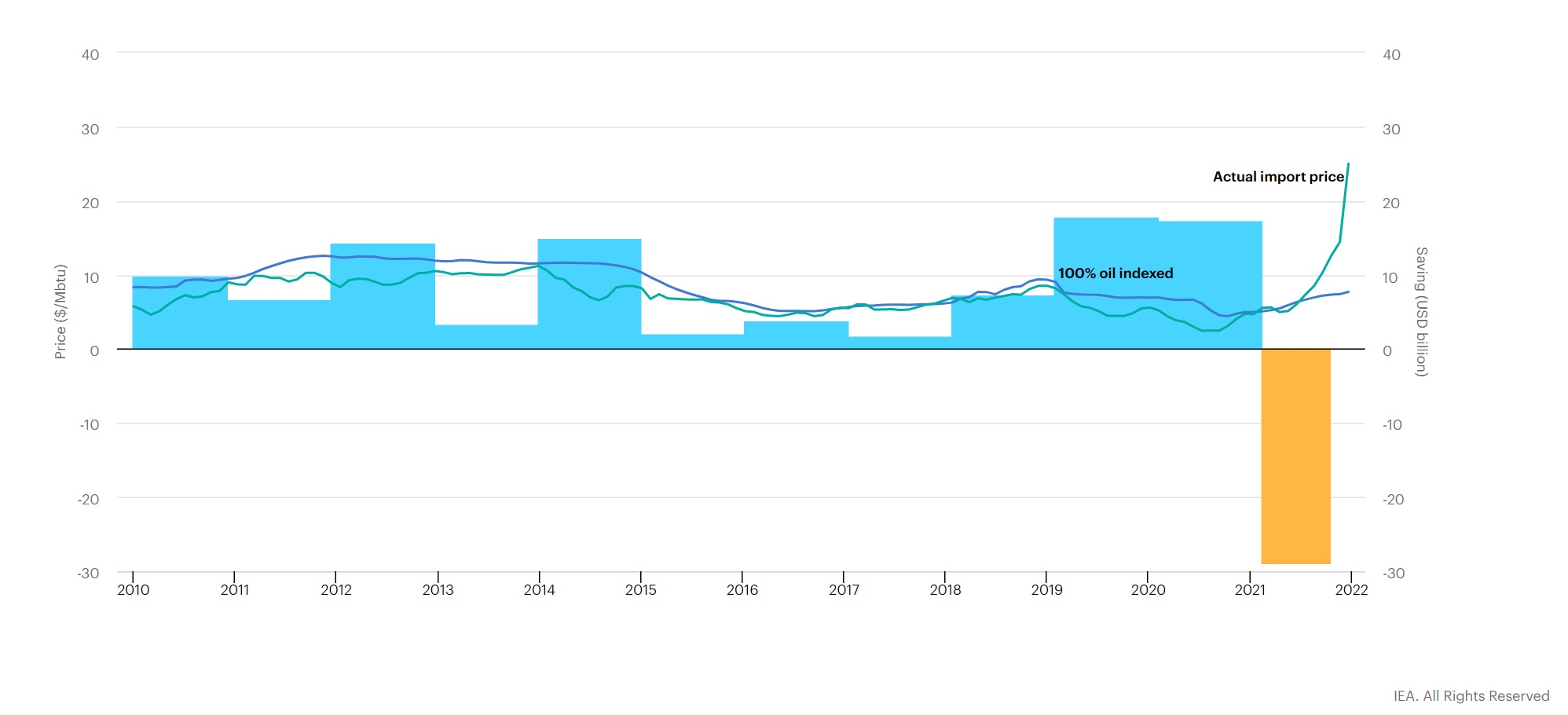

In 2006 the European Commission launched an antitrust investigation into Gazprom, E. ON, EDF and OMV, known for cooperation with this Russian company on the projects Nord Stream 1 (consortium) and Nord Stream 2 (financial partners), suspecting these major market participants of non-market practices. The investigation ended only in 2009 with a settlement criticized by some market participants, such as PGNiG from Poland or Naftogaz from Ukraine. Still, the Commission did formally rule that Gazprom was abusing its dominant position. The Russians abused it by restricting access to infrastructure, implementing unfair prices and sharing markets. Brussels has admitted that it had no influence on intergovernmental agreements such as the Yamal agreement in Poland. The Commission’s findings were used to design the third energy package. This is a series of regulations liberalizing the market from 2009, which include ownership unbundling, free access of third parties and independent tariffs. The Nord Stream 2 pipeline is now to be subject to these rules, in accordance with the European Union gas directive. These regulations are designed to protect customers from supplier abuse. The International Energy Agency estimates that EU member states will pay in 2021 about USD 30 billion more for gas, than if they had stuck with indexing to the oil price index. However, thanks to increasing the number of contracts indexed to the stock exchange from 30 percent in 2010 to 80 percent in 2020, they have already accumulated about USD 70 billion in savings on cheaper gas. However, the gas crisis came, which suddenly reduced the attractiveness of gas exchanges like the TTF and made the index to the price of a barrel in 2021 temporarily attractive again, giving greater predictability, considering the fluctuations.

Savings on the stock market formula. Graphic: International Energy Agency.

The new price dictate

The liberalization of the gas market has provided greater flexibility and lowered gas bills, but also caused a greater exposure to fluctuations in the stock market. The oil index did not reflect the actual supply-demand relationship in the contracts. The conditions depended on the position of the supplier, which in the case of Gazprom was dominant and, according to the Commission’s findings, was abused. It can be suspected that this Russian company has reduced the supply of gas to Europe in 2021 in order to reverse this trend, which in the long term works to its disadvantage. This is the argument for a second antitrust investigation by the European Commission, which can confirm the recidivism, and this time lead to more painful consequences for the Russians. An interesting thread, albeit abandoned during the first investigation launched by the EC, was the role of Gazprom’s intermediaries and partners, including Engie, OMV and E.on., in the Nord Stream 2 project. Perhaps they have been and will continue to be involved in creating a price dictate in Europe, which the Breugel think thank wrote about back in 2017. Parties that sign an attractive contract during a gas crisis may learn that once the emergency is over, their partner will go back to its old abusive practices, while a new price dictate after 2022 poses a real threat to the EU energy security. Gas stocks in Europe are at a record low and may not be replenished in the summer of 2022, dragging the gas crisis into 2023. Some analysts warn that the shortage of gas in Europe may last until 2025, when new LNG projects in the US will appear on the market to increase supply. If Ukraine were to cut off its gas supply because of Russia stirring internal destabilisation or because of Russian aggression, for example, the situation would deteriorate further. We should be prepared for such a scenario as well. Reuters sources say that the U.S. government announced talks with a number of gas suppliers in Europe on emergency supplies in the event Russia starts a new war against Ukraine. Additional LNG is already coming to Europe. The US fears that Russia is preparing a new attack on Ukraine, while it is the main supplier of gas to Europe, responsible for more than a third of the supply of this fuel. The interruption of supplies via Ukraine could exacerbate the energy crisis, which is still here, because Russia is limiting the supply, among other reasons. The US State Department allegedly talked with European companies about how much they could increase supplies to the European market if necessary. It found that there are small amounts of gas that can possibly replace supply from Russia.

Anything but Nord Stream 2

The answer to Gazprom’s threat is to increase the production of European gas, which has already occurred in Denmark and Norway. This, incidentally, is important from the point of view of the Baltic pipeline project to Poland, which is supposed to make it possible to sign a safe, long-term contract with a country that is not Russia. The Tyra deposit in Denmark, which was to be abandoned due to the country’s advanced energy transition, has been revitalised. Similarly, the Dutch are holding off on closing the largest gas deposit in Europe, Groningen, and increasing production there in case of shortages. The transition should take place with limited use of gas as a transition fuel, in order to avoid increasing dependence on Russian imports. Developing nuclear energy is also very important, as it reduces the role of gas in the energy industry during the transition. The International Energy Agency estimates that demand for this fuel will peak in the mid-2020s, and it will drop by 20 percent, or almost 90 billion cubic meters by 2040. The IEA warns that effort should be made to increase the use of heat pumps instead of gas boilers, in order to reduce household price exposure to gas price fluctuations. Another answer is the development of liquefied gas supplies, including from the United States. It was the development of the stock market that allowed for the free conclusion of spot contracts for the supply of LNG, which alleviates the impact of the energy crisis on the gas market. Those who buy this fuel fight for LNG contracts with Asians. In the long term, it is a market tool for strengthening security of supply, which also reduces prices by offering choice. Bloomberg reported in mid-January that a total of 41 LNG tankers are heading to Europe, compared with 24 destined for Asia. The shorter supply route and record prices on the Old Continent encourage suppliers to divert liquefied gas there. One of the beneficiaries is Poland, which imports liquefied gas from Qatar, the USA and other destinations. From this perspective, Gazprom’s game for new long-term contracts is its final charge to keep the market, which will be shrinking, provided that Europeans do not get bogged down in dependence on Russian raw materials, for example, because of projects like Nord Stream 2. This is another argument against its launch from the point of view of energy security, and therefore an important card in the certification process, which the German regulator Bundensnetzagentur intends to complete in the second half of 2022. The new assessment of the German Ministry of Economy and Climate, which is necessary for the resumption of this process after the organisational changes required of Gazprom, should therefore be negative.

Polish fuse

If the energy crisis in the gas sector lasts for several years, the crisis solutions introduced by the Polish lawmakers in order to protect gas consumers against price fluctuations will stay put longer. These include lower tariffs for vulnerable customers such as hospitals, schools and nurseries, the inclusion of individual customers from cooperatives and housing communities in the tariff, compensation for gas sellers and protection of stock market deposits, protection of stock market deposits and transfering responsibility for stocks to the Government Agency for Strategic Reserves. These are crisis solutions introduced at the time of record prices, which have not yet become a pretext for canceling the government’s plan to liberalize the gas market by freeing up prices for households in 2024 in line with the spirit of legislation that has been developing in Europe for over a quarter of a century. Compensation for the seller, if necessary, up to PLN 20 billion will not be additional income. They will be exactly as much as this entity, primarily PGNiG, will lose on the sale of gas below the cost of its purchase, which is currently record high. This mechanism is also intended to allow for the calculation of lower tariffs reduced by compensation, and thus appears as a tool to protect consumers and not the interests of PGNiG. It will give the company the flexibility it needs to keep its gas supply stable even in times of crisis. PGNiG is the only company that has an energy security clause in its statutes that allows it to act against market logic for the benefit of its customers. One can imagine that when purely market-based companies fall out of the market due to the crisis, PGNiG will be the last safe haven operating on behalf of the state. It is worth noting that we should expect even more drastic solutions in the event of a crisis in Ukraine, including gas rationing. The spectre of introducing a specific war economy in the face of the shortages currently observed in Europe should at least be taken into account as the worst case scenario in the strategic plans of every European state.

Playing for a new contract in Poland

It is not by chance that in the breakthrough year of 2022, the pressure is growing on the Polish PGNiG to sign a new Yamal contract with the Russian Gazprom. This pressure includes fake news about a “PiS formula” (PiS – Law and Justice, ruling party in Poland – ed.), determined as part of the victorious arbitration procedure in 2020, and Gazprom’s application for a new arbitration on prices as of November 2017, submitted in mid January. It is a customary counter attack by the Russians, who always respond to Polish requests for reductions with a similar appeal for a raise, showing how they treat their partners. This is not a “PiS formula” as suggested by anonymous dumps on the internet, more likely European, besides, it was not fully adapted to the expectations of the Poles and the European Commission, but only close. The Russians, on the other hand, want to convince the Poles that gas will be cheaper only in the new contract, and spot and supplies from outside Russia are no longer attractive. They do this in spite of the facts presented above, but they may find supporters. According to information obtained by BiznesAlert.pl part of the government and the opposition is inclined to sign a new long-term agreement with Gazprom.

The victory of the Polish PGNiG in the arbitration court in Stockholm was possible thanks to antitrust regulations. As part of the ruling, the price formula was changed and its dependence on oil was reduced, while its indexation to the TTF gas exchange in the Netherlands was increased. Contrary to popular belief, the oil formula was not replaced by one based on stock-exchange prices. This decision was in line with the spirit of liberalisation of the gas market in the European Union, which has been present for almost a quarter of a century. PGNiG’s requests to revise the price rejected by Russian Gazprom in 2014, 2020 and 2021 also sought to change the price formula in this direction. Merging gas markets and developing gas exchanges in the EU made it possible to lower the prices by moving away from the oil index in favour of the stock exchange. PGNiG requested the price change in November 2020 and modified the request in October 2021. It considers Gazprom’s request for arbitration to be unfounded. The Kommersant daily argues that because of the energy crisis, gas prices at the spot are now more than USD 1,000 per 1,000 cubic meters, while prices in contracts dependent on the value of oil and thus reach USD 300 for the same amount. However, since November 2017, spot prices were regularly lower than those in Gazprom contracts, not counting the second half of 2021, i.e. the beginning of the energy cirisis. Nevertheless, Kommersant does not mention that the International Energy Agency has found Gazprom guilty of imposing record gas prices by deliberately limiting the supply of gas to Europe. The European Commission is also investigating where this supply drop came from, which vice-president Margrethe Vestager says is “suggestive”. According to the findings of BiznesAlert.pl, some in the Polish government and the opposition claim that it is necessary to sign a new long-term contract with Gazprom, where the price formula will depend on oil. This would mean Russia would win its game against Europe, which in the worst-case scenario can cause a war in Ukraine. Perhaps Gazprom’s game was planned in the spring of 2021, when unexpectedly Gazprom Export CEO Yelena Burmistrova had nice things to say to Poland. “Poland is our reliable partner, a wonderful country. We have been cooperating for a long time, negotiations are traditionally ongoing. Despite the historical realities, we still live, thank God, in the economic field. Of course, there are statements from politicians, companies, but at the same time there is such a daily routine work and, of course, we cannot not do it. We still have many disputes with the Poles, but at the same time we continue trade negotiations,” Burmistrova said. PGNiG replied it was not negotiating about prolonging the Yamal contract. It would be inappropriate for anyone to ask and threaten this company to change its mind.

The gas war for Europe is just getting under way

Poland faces the specter of several years of a gas war, which can reach varying degrees of intensity: from the high prices observed today to gas rationing in Europe. For this reason, it is in the strategic interest of the state to maintain existing coal-based generation capacities until the energy crisis is over, to reduce dependence on gas in the energy transition process, to implement the nuclear power plant construction program as soon as possible, to maintain independence from Russian gas after 2022 through diversifying infrastructure in the form of LNG terminals and the Baltic pipeline, as well as to cooperate with partners in the European Union, the USA, Norway and Qatar. It is therefore not a question of not transferring a single molecule of gas from Russia, but of refraining from the temptation to conclude a new long-term contract. Gazprom wants to use the energy crisis to challenge European rules for the functioning of the gas market and impose its own, known from the unfavorable Yamal contract in Poland. “Nord Stream 2 does not only export gas, but also exports Russian business culture,” said Polish Foreign Minister Zbigniew Rau. The emergency solutions on the Polish gas market should be withdrawn after the end of the crisis in the spirit of the liberalization of the gas market that has been in place for several years, for the good of the clients in Poland and Europe.

PL

PL EN

EN