In the midst of the energy crisis and the political dispute over the Yamal contract with Gazprom, it has been suggested that the Baltic Pipe, which is to replace Russian gas with Norwegian, will not have enough gas. Domestic gas production and proper contracting should protect us against this problem – writes Wojciech Jakóbik, editor-in-chief at BiznesAlert.pl.

Is there enough gas in Norway for Baltic Pipe?

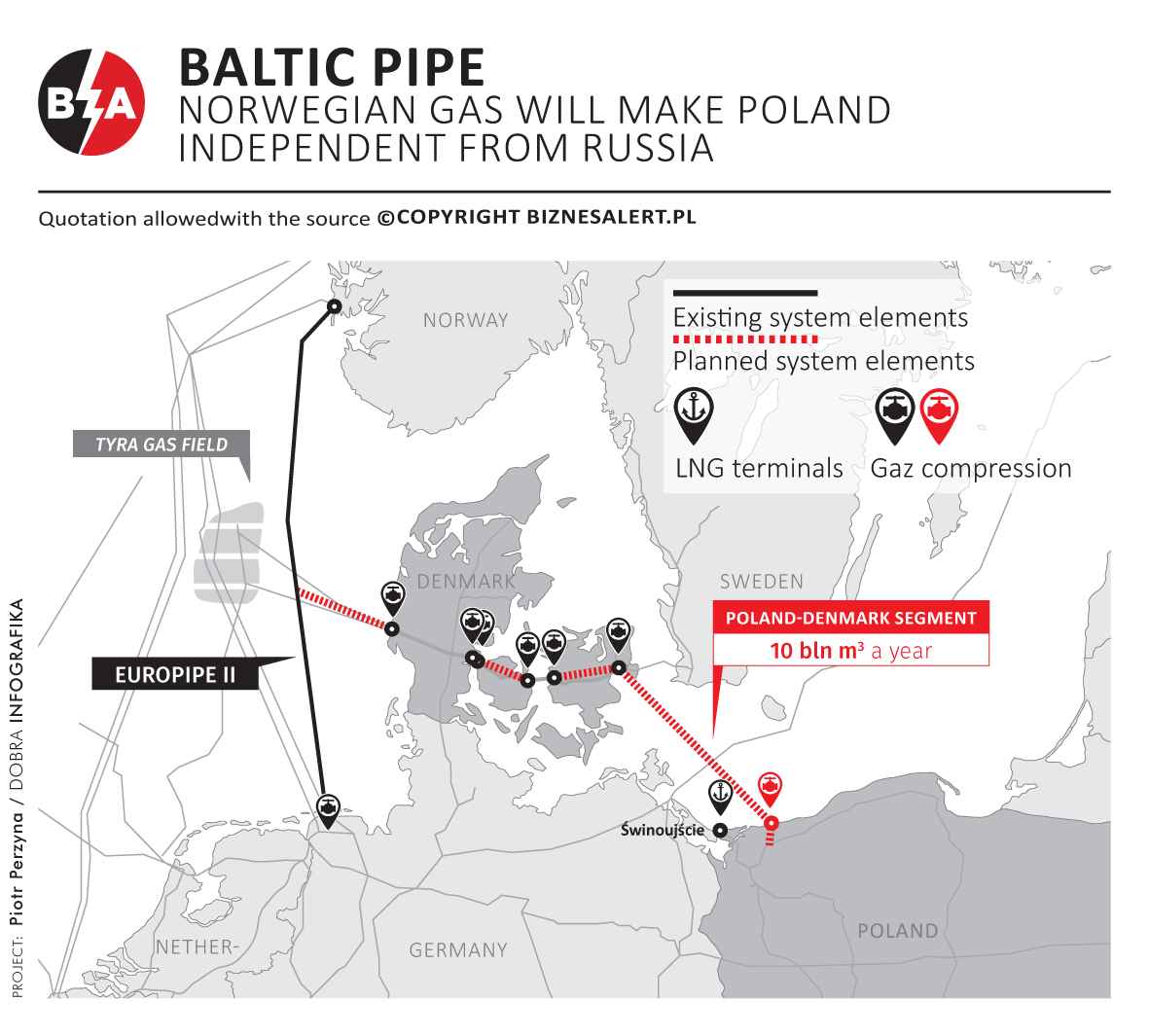

The discussion on whether Poland should sign a new contract, similar to the Yamal agreement from 1993, sparked by former deputy prime minister Waldemar Pawlak took an interesting turn. He argued that Poland doesn’t need the Baltic pipeline, which is due to start operation at the end of this year. At the same time, a new claim has emerged, according to which the pipe won’t have enough gas. „For the most part, Waldemar Pawlak is right. Where is the Baltic Pipe connected? How much capacity does the pipe to which it is connected have left?”, Stanisław Gawłowski, a senator from the Civic Coalition, wrote to me on Twitter, reflecting the deliberations on this subject that have been taking place off the mic for at least the past few months. „The Baltic Pipe is not connected to the PGNiG deposits in Norway, but to Europipe II, which runs only to Germany and not from specific deposits, but from Karsto,” explains a BiznesAlert.pl source requesting anonymity. „The Baltic pipeline should go deeper into the Norwegian gas pipeline system and into the Ekofisk area, where PGNiG actually has deposits,” he adds, warning of German influence on the Baltic pipeline.

The Europipe II pipeline runs from the Norwegian fields where PGNiG holds 62 mining concessions in Karsto, Norway, to the Emden metering station in Germany. It is worth adding that along it runs Europipe I with a yearly capacity of 12 bcm, to which the Baltic Pipe will not be connected. The operator is the Norwegian company Gassco. The capacity of Europipe II is 24 bcm a year. It is one of the main sources of gas supply from outside Russia to western Europe, in addition to connections with Benelux and the UK that has many LNG terminals. The Baltic Pipe is connected to Europipe II by means of the so-called „plug” laid in May 2021. Its capacity is 10 billion cubic meters. The energy crisis and record low gas supply to Europe, including Germany, suggest that in case Russia attacks Ukraine and the transfer through that country is stopped, it will take several days before Berlin runs out of gas. This has been reported by the Commerzbank, quoted in another article on BiznesAlert.pl. According to AGSI + data, stocks in all German gas storage units are at 41 percent of capacity. Astora’s gas storage facilities, which are owned by Russia’s Gazprom, are full at just 11.84 percent. These data prompted the International Energy Agency to accuse Russia of purposefully limiting gas supply to Europe. It is a gas trap, which may even lead to a new aggression on Ukraine without far-reaching consequences. It is worth recalling that the US and Germany are threatening the Russians with sanctions, which will include, among others, Gazprom. It is not clear whether the European Union will be able to impose these restrictions in view of gas shortages.

This, in turn, is a reason to suspect that in case of shortages, the Poles will compete for gas with Germany. „Norway has been Germany’s energy partner for 40 years. We are now meeting a third of the country’s demand and we are meeting it in full, ” said Prime Minister Jonas Gahr Store on German television. „We are working at full speed, we don’t have the reserves that would completely replace other sources,” he added, referring to the supply from Russia. The media in Germany have suggested that this is only about replacing gas from Nord Stream 2. It is worth mentioning that there is no need to replace additional gas from this pipe, because NS2 is intended to redirect transmission from Ukraine and not increase it. Russians are reducing supply to Germany via the Yamal gas pipeline and have not transmitted gas along this route as of 21 December 2021. Rystad Energy estimates that Germany imported from Norway in 2019 before the pandemic 27 billion cubic meters. This is a little over the capacity of Europipe II, but less than its combined capacity with Europipe I. Together the pipes can transmit 36 bcm a year. If we subtract from this figure, Germany’s pre-pandemic imports come out at 9 billion cubic meters. This is close to the capacity of the Baltic Pipe. Additional demand in Europe could increase the pressure on gas competition between Germany and Poland, but the problem is Gazprom’s insufficient supply. Germany, on the other hand, is counting on gas from the Nord Stream 2 pipeline, which has a capacity of 55 billion cubic meters a year. Probably the project’s financial partners are already among the clients waiting for the pipe to start working. Therefore, it is not certain that they will need additional gas from Norway, especially since Rystad Energy argues that Nord Stream 2 will be the cheapest option, while BiznesAlert.pl ascertained that it can be subsidized by the Russian Federation for political purposes, and thereby go bankrupt due to the almost 3-year delay, because the pipe had been originally supposed to launch at the end of 2019.

A contract or a few Norwegian contracts?

However, the Polish PGNiG has theoretically secured gas for the Baltic Pipe. Currently the company extracts 2.5 bcm a year in Norway, either as part of its own licenses or in cooperation with other firms. The goal is it produce 4 bcm a year. The remaining 8.3 bcm a year booked by PGNiG as part of the open season procedure for the Baltic Pipe, has already been contracted or will be contracted on the Norwegian market by Equinor and other players. One can expect that the preparations for an agreement on this issue have already started, because Poland wants to replace the long-term gas contract with Gazprom, which will expire at the end of 2022, with a deal with Norway as of 2023. It would be unprofessional if such an agreement was missing several months before the launch of the Baltic Pipe. It can also be suspected that there will be a number of smaller contracts to spread the risk and obtain better terms through competition from potential suppliers. If part of the Norwegian gas for Poland is under the control of PGNiG and the remaining amount has been contracted, it should not run out by the end of 2022 and it will be possible to replace the old Yamal contract with a new contract or several Norwegian contracts. Officially, PGNiG assures that it has secured gas from Norway. Unofficially, most of the capacity has been already contracted. However, the agreement has not been revealed, because it is a trade secret, a practice prevalent in the gas sector. Nevertheless, some experts are impervious to this knowledge, and continue to argue for a second Yamal contract with Russia, which would bury the efforts put into diversifying gas supply to Poland over the past several years. The German Minister of Economy and Energy Robert Habeck is a good example here, as he admitted that Germany currently imports 55 percent of gas from Russia. The alternative is to buy LNG through European terminals, which currently are used at about 30 percent. If this was increased to 100 percent, Germany could get most of its gas in liquefied form. Habeck admitted that Germany does not have sufficient control over its gas storage facilities. For example, the Stocks Acts in France and Poland oblige companies to collect mandatory reserves in case of a crisis. It is thanks to that Act that Poles have record high gas stocks. According to AGSI + data, Polish gas storage facilities are now 72 percent full.

Breaking free from Russia is worth it

It is worth noting that Norwegians took into account the increased demand for gas in Poland, Germany and the whole of Europe, caused by the energy crisis fueled by Russia’s Gazprom, and already in September 2021 promised to up gas exports. Norway upped export by 2 bcm as of 1 October 2021, which is an increase by 2 percent from the 100 bcm it transmits to Europe every year. Last year Norway extracted 113 bcm of gas. This record was possible, because a number of new fields were opened. One of those was Aerfugl, which is considered one of the most precious assets of PGNiG, as it increased the output of PGNiG Norway from 0.22 to 0.57 bcm a year. It is also worth mentioning that as of 2022-23 the Baltic Pipe will be able to tap into the Tyra deposit on the North Sea, as Denmark decided to renovate its platform on that field. Americans are to talk with suppliers to Europe about emergency supplies in the event of a war, including Qatar. The current crisis shows that Poland’s long-term policy of becoming independent of gas from Russia with the help of supplies from Qatar, the USA and Norway was right.

When in fear, Russia is near

If the declarations made by PGNiG are confirmed, there will be no problem with securing supply for the Baltic Pipe and replacing the Yamal contract with new contracts outside the Russian Federation. Whereas due to the growing demand for gas in Poland, it will need an additional 2.1-3.8 bcm in 2023. Still, it will not be necessary to sign a new long-term contract with Gazprom to meet that demand.